Irs pay estimated taxes online 2021

This includes self-employment tax and the alternative minimum tax. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Make an Individual or Small Business Income Payment.

. The final quarterly payment is due January. If you owe additional taxes during the year you may have to pay estimated tax on the upcoming year. Online file and pay file Form NC-40 and associated tax.

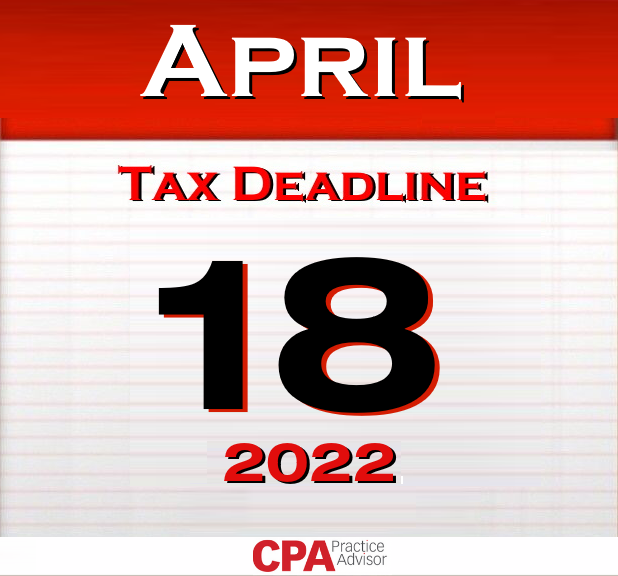

Form 1040-ES and Payment. In 2021 estimated taxes are due on April 15 June 15 September 15. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

By Patrick Thomas Last. Do not mail Forms 540-ES to us. Complete Edit or Print Tax Forms Instantly.

The rate rose to 6 per year for the quarter beginning. Realty Transfer Tax Payment. As a partner you can pay the estimated tax by.

Payment vouchers are provided to accompany. IR-2022-77 April 6 2022 The IRS today reminds those who make estimated tax payments such as self-employed individuals retirees investors businesses corporations and others that the. The IRS may apply a penalty if you didnt pay enough estimated taxes for the year you didnt pay the required estimate amount or didnt pay on time.

But during my 2020 taxes Turbotax printed vouchers for Estimated. Pay IRS Taxes Online Guide Benefits 2021-22. To determine if these changes.

Use Form 1040-ES to figure and pay your estimated tax for 2022. Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for more information. I was in the US on work visa during 2020.

Pay Irs Taxes Online Taxes are the biggest source so farming for any government in the world. Estimated payments can be made using one of these options. Ad Access IRS Tax Forms.

The payment periods and due dates are. Tom Wolf Governor C. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self.

Scheduling tax payments for 2020 and 2021 was a breeze. The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates. In future I may not live in the US as my contract is finished.

Make your check payable to the United States Treasury and indicate the year you are paying your estimated taxes. Aside from income tax taxpayers can pay other taxes through estimated tax payments. And for credit or debit card payment the deadline is midnight on the due date.

Ad Use our tax forgiveness calculator to estimate potential relief available. The IRS has been rapidly increasing the penalty rate interest charge on underpayments of income tax liabilities. Individual Payment Type options include.

See below for options to file your estimated taxes. Crediting an overpayment on your. Ad Download or Email OR OR-40 More Fillable Forms Register and.

An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Visit Alabama Interactive for online.

Personal Income Tax Payment.

What To Do If You Receive A Missing Tax Return Notice From The Irs

New 2021 Irs Income Tax Brackets And Phaseouts

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Top 8 Irs Tax Forms Everything You Need To Know Taxact

How To Pay The Irs Online Pay Income Taxes Pay The Irs Taxes Online By Mail Pay 1040 Online Youtube

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

Irs Offers Multiple Ways To Pay

Here S Why Actually The Irs 600 Bank Reporting Proposal Is Entirely Reasonable

Irs Tax Notices Explained Landmark Tax Group

Estimated Tax Payments Youtube

How To Get Irs Tax Transcript Online For I 485 Filing Usa

Pin On Form W 8 Ben E

Pin On Hhh